Social Security Limit 2025 Salary Cap. In 2025, the earnings limit for early claimants is $22,320. In other words, if your income exceeds the cap on yearly earnings — which in 2025 is $22,320 for people who claim benefits before full retirement age — social.

We call this annual limit the contribution and benefit base. In 2025, this limit rises to $168,600, up from the 2025.

If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520.

Social Security 2025 Limits Aili Lorine, So, if you earned more than $160,200 this last year, you won't. If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520.

Social Security 2025 Limits Aili Lorine, In other words, if your income exceeds the cap on yearly earnings — which in 2025 is $22,320 for people who claim benefits before full retirement age — social. The limit is $22,320 in 2025.

Social Security Earnings Limit In 2025 Beckie Rachael, 11 rows if you are working, there is a limit on the amount of your earnings that is taxed. For 2025, that maximum is set at $168,600, an increase of $8,400 from last year.

Limit For Maximum Social Security Tax 2025 Financial Samurai, (the figure is adjusted annually based on national changes in average wages.) you lose $1 in benefits. The maximum social security benefit you can receive in 2025 ranges from $2,710 to $4,873 per month, depending on the age you retire.

Social Security Limit What Counts As YouTube, The typical senior gets less than $2,000 per month. In other words, if your income exceeds the cap on yearly earnings — which in 2025 is $22,320 for people who claim benefits before full retirement age — social.

Social Security Limit On Earnings 2025 Wynny Karolina, In 2025, if you’re under full retirement age, the annual earnings limit is $22,320. The maximum amount of earnings subject to the social security tax (taxable maximum) will.

What’s the Maximum 401k Contribution Limit in 2025? (2025), Workers earning less than this limit pay a 6.2% tax on their earnings. We call this annual limit the contribution and benefit base.

2025 Social Security Limit YouTube, When the payroll tax dedicated to social security was first implemented in 1937, it. Be under full retirement age for.

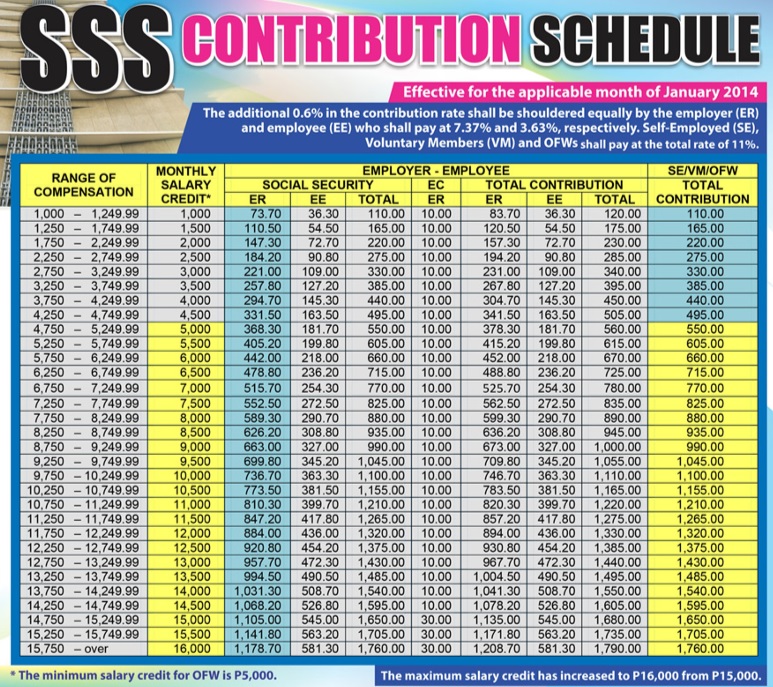

Sss Table Of Contribution 2025 Silva Faustine, You aren’t required to pay the social security tax on any income beyond the social security wage base limit. If your retirement plan involves falling back on social security alone, here's some important information.

Limit For Taxable Social Security, In 2025, if you’re under full retirement age, the annual earnings limit is $22,320. The social security administration also announced the 2025 wage cap.

The maximum social security benefit you can receive in 2025 ranges from $2,710 to $4,873 per month, depending on the age you retire.

You aren’t required to pay the social security tax on any income beyond the social security wage base limit.